To sell insurance or work as a claims adjuster in the State of Florida, you must be both licensed (by the State) and appointed (usually by your employer). You apply with the State for both of these. All licenses require prerequisite pre-licensing education and a State Exam, with some exceptions. All pre-licensing courses require you to purchase the appropriate State study manual. We also have two Designation courses; these special kinds of pre-licensing course waive the State Exam and do not require the purchase of the State Study manual (although the State still highly recommends you purchase it).

Common Claims Adjuster Licenses, and Educational Prerequisites

To adjust claims for a company or to be an independent adjuster, you must obtain your 6-20 All-Lines License. You start with our 40-hour Accredited Claims Adjuster Designation course, INS013FL40. Our Designation courses waive the State Exam, saving you time, effort and money!

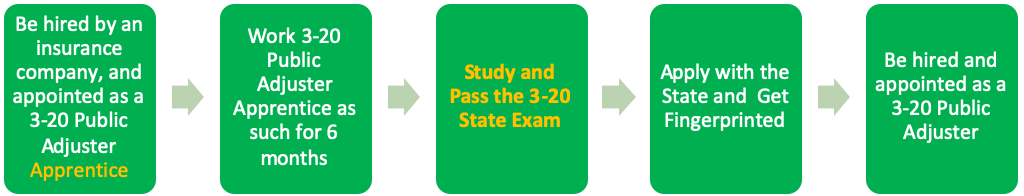

If you want to become a Public Adjuster, adjusting claims on behalf of and employed by a consumer, you must first gain your 6-20 license (see above), become licensed and appointed by a Public Adjuster or firm as a Public Adjuster Apprentice. You then work for at least six months in this position and then can take the Public Adjuster State Exam and apply for the 3-20 Public Adjusters License.

There is no State Exam required for the 6-20 Adjuster license if you take our designation course. The 3-20 license does require a State Exam, but we currently do not have any study aids for this Exam. You will learn on-the-job in your 31-20 Public Adjuster Appointment working under your 6-20 license.

For further details on any of these licenses or others, contact the Florida Department of Financial Services at (850) 413-3137, or visit https://www.myfloridacfo.com/Division/Agents/Licensure/General/default.htm.

Do I need to purchase a State study manual if I take your course?

Yes, Florida requires all pre-licensing students to purchase their appropriate manual. We have them available here: https://oltraining.com/ec/book-store. Students in Designation courses are not currently required to purchase the State study manual, but the State highly recommends them.

The following is a flow chart of the progress from course to license and their common uses. Moving from the 6-20 All-Lines Adjuster to the 3-20 Public Adjusters License is of course optional.

Common Use(s) of 6-20 All-Lines Adjuster License:

An “independent adjuster” means a person licensed as an all-lines adjuster who is self-appointed or appointed and employed by an independent adjusting firm or other independent adjuster, and who undertakes on behalf of an insurer to ascertain and determine the amount of any claim, loss, or damage payable under an insurance contract or undertakes to effect settlement of such claim, loss, or damage.

A “company employee adjuster” means a person licensed as an all-lines adjuster who is appointed and employed on an insurer’s staff of adjusters or a wholly owned subsidiary of the insurer, and who undertakes on behalf of such insurer or other insurers under common control or ownership to ascertain and determine the amount of any claim, loss, or damage payable under a contract of insurance, or undertakes to effect settlement of such claim, loss, or damage.

Common Use(s) of 3-20 Public Adjuster License:

A “public adjuster” is any person, except a duly licensed attorney at law as exempted under s. 626.860, who, for money, commission, or any other thing of value, prepares, completes, or files an insurance claim form for an insured or third-party claimant or who, for money, commission, or any other thing of value, acts on behalf of, or aids an insured or third-party claimant in negotiating for or effecting the settlement of a claim or claims for loss or damage covered by an insurance contract or who advertises for employment as an adjuster of such claims. The term also includes any person who, for money, commission, or any other thing of value, solicits, investigates, or adjusts such claims on behalf of a public adjuster.